|

Safety under siege

Safety distributors are defending an onslaught of competition from alternate channels of distribution.

by Richard Vurva

Conventional wisdom says to pick a niche and develop a strategy to serve that niche better than your competitors. But what happens when conventional wisdom goes awry? How should niche players respond when they begin losing business to competitors outside their industry?

Thats what is happening to safety distributors. They are increasingly losing market share to general-line industrial distributors and integrated suppliers.

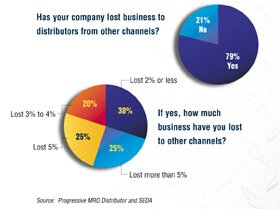

A recent survey of members of the Safety Equipment Distributors Association (SEDA) conducted by SEDA and Progressive MRO Distributor magazine shows 79 percent of safety distributors report losing business to alternate channels of distribution in the past year.

Half of the survey respondents say they lost at least 5 percent of sales to alternate channels. In other words, using data from the 1998 Profit Report, compiled by Boulder, Colo.-based Profit Planning Group, for a typical SEDA distributor with $9.8 million in sales, revenues were $490,000 lower than they might have been.

The survey results also offer clues as to why sales are migrating to other channels.

Two primary reasons surfaced:

1) In an effort to reduce acquisition costs, customers are consolidating suppliers and grouping safety products into other commodity buckets.

2) Safety distributors have done a poor job of demonstrating their value in the supply chain.

The commodity trap

To the chagrin of distributors and manufacturers, customers view safety products no different from other MRO products they buy. As a result, when customers begin to pare down their supplier bases, its an easy decision to start ordering protective eyewear, hard hats, gloves, harnesses and other personal protective equipment (PPE) from full-line industrial distributors.

Our products are becoming commodities, says Rick Pedley of PK Safety Supply in Oakland, Calif. A competent, experienced and highly trained salesperson makes the sale, but the order goes to bid.

Thats especially true when buying decisions are ultimately made by purchasing departments.

Typically, materials management people tend not to care whether they buy from a safety distributor or a general-line distributor, says Richard Crannell of Safety Equipment Co. in Tampa, Fla. In companies where they do care, its because the safety department has done a good job of selling the materials management group on why the safety folks need to have a certain type of vendor.

Says Thomas Gray of Clement Safety Equipment, Memphis, Tenn.: Mid- to upper-level management consider safety products a commodity expense and do not see the danger of relying on integrated suppliers who have very little applications knowledge.

Springing the trap

How can safety specialists free themselves from the commodity trap?

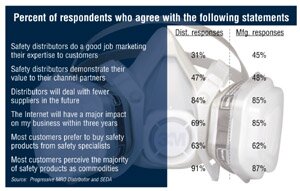

An overwhelming majority of SEDA members manufacturers and distributors alike believe distributors must do a better job of communicating their value to their customers. When asked to agree or disagree with the statement, Safety distributors do a good job marketing their expertise to customers, 69 percent of distributors and 55 percent of manufacturers disagreed.

Safety distributors need to do a better job of explaining their value, says Craig Wagner of Best Manufacturing in Menlo, Ga.

Like many manufacturers and distributors responding to the survey, Wagner believes safety distributors perform a variety of value-added services for customers, such as respirator fit testing, hand protection site assessments and safety audits. What distributors often fail to do, however, is quantify the value of those services.

A lot of times a safety distributor goes in and provides a service and two years later theres a management shakeup at the end-user, Wagner says. A new buyer comes in and doesnt know that past history.

Wagner suggests distributors will benefit if they do a better job of documenting all of the activities they do for customers.

Marketing value

How can safety specialists reposition themselves to customers? For starters, pay heed to successes experienced by some distributors that have unbundled their services from the cost of the products sold.

For example, Houston-based Vallen Safety markets its Vallen Knowledge Systems, which offers in-depth audits to identify unsafe work conditions or practices and provides trained professionals to serve as safety consultants to customers.

PK Safety aligned itself with outside consultants who perform training to PK customers.

Orr Safety, headquartered in Louisville, Ky., employs eight full-time environmental health and safety consultants who do site assessments and develop safety training for customers in various industrial environments.

You must have people who can explain to customers the impact of injuries on their bottom line, says Jerry Nichter, Orr Safety president.

His company also developed a system to track and measure product use for customers and compare that data with injury statistics. Say, for example, that a company wants to institute a glove program. Orr Safetys system tracks the number of gloves issued to individual employees. If a machine operator cuts his hand six months from now, data will show whether or not that worker was issued gloves.

Reviewing injuries and going after those in a strategic way helps customers understand theres much more cost in litigation and in workers compensation than in the cost of products, Nichter says.

Nichter says its often difficult to sell the concept to customers. Many buyers look only at the cost of products.

Thats why its imperative for the industry to continually emphasize the steps safety distributors are taking to set themselves above competitors. Distributors must spend time and money training salespeople to maintain a competitive advantage.

The biggest thing we have going for us is the Qualified Safety Sales Professional program, says Steve King, executive director of SEDA.

He says safety specialists need to promote the fact that they have employees on staff with a solid grounding in technical and regulatory aspects of safety.

In the early years of the program, it was a struggle to get people to sign up, King says. That has changed in the last year. The sessions are selling out. Our education committee is talking about expanding the program.

The goal is to help distributors make the switch from selling products to selling services.

Says Harry Neff of Uvex Safety: The distributors that are not focusing on selling services and value-added, but instead focus on only product, will likely have a disadvantage in the new market.

Threats to the channel

When asked to identify the biggest threat to safety specialists, integrated supply was most often named by distributors who responded to the survey.

Some distributor respondents question why manufacturers would want to establish relationships with integrated suppliers from outside the traditional safety channel.

All the integrated houses do is deteriorate margins for other distributors and manufacturers and offer little or no support, thus giving the manufacturer a bad name, says Keith Varadi of Premier Safety & Service, Oakdale, Pa.

Distributors arent alone in pegging integrated supply as a potential threat. Manufacturers also named it as an area that causes them concern. They worry that by moving products through alternate channels, they run the risk of offending long-time channel partners. However, manufacturers must balance that possibility against the risk of losing important customers.

Our customers have come to us and said, You will sell to us through XYZ company, says Chris MacKenzie, sales manager for Mine Safety Appliances Co. in Pittsburgh. We may be forced to accept them as a distributor based on the fact that an end-user customer demands their services. Its not good business practice to require a customer to issue a separate purchase order when all other purchases have been consolidated.

Uvex Safetys Neff says more than 50 percent of the distributors Uvex has added to its network in the past five years are non-safety distributors.

Neff adds that integrated supply has forced manufacturers to refocus their sales and marketing efforts.

Safety manufacturers have had to focus more of their selling time at the end-user in an attempt to pull through the product lines and get the end-users aware of their brands, he says. In the past, a lot of the effort from the manufacturer was selling to the distributor. That was seen as our ultimate customer. In reality, the ultimate customer is the one who uses the product.

Some safety specialists have already developed their own integrated supply programs. Others are forming alliances to compete in that arena.

Safety Equipment Company is a member of the Florida Integrated Supply Consortium (FISC), a group of five distributors aligned to seek out customers that want to have integrated supply, yet prefer to do business with local, service-oriented distributors.

The year-old consortium includes distributors from five niches: electrical; pipes, valves and fittings; fasteners; rubber and safety.

Each of those disciplines is a specialized area, Safety Equipments Crannell says. So the customer is able to hire FISC as an integrator, have one billing point and one shipping point if they want, yet still have the specialty knowledge and service being done by the individual companies.

Other safety houses are selectively expanding their line cards for key customers.

Choose your customers wisely, advises Mike Stamn of Conney Safety in Madison, Wis.

Not everyone wants integrated supply, he says. There are customers that want extra-special service. In those areas, we try to provide the special services and technical support the customer needs, and try to offer products that expand upon the safety theme.

Former SEDA president Fred Loepp, a vice president at W.W. Grainger, says there is plenty of business to go around for specialists and integrators.

I think there are niches for the pure safety houses, he says. They have to find those niches. They have to find the niche where they can participate and provide more value than the integrator does.

Stamn believes complacency is the biggest danger to the future of safety specialists.

If a safety distributor cant offer value-added services that are relevant to the customer, then the customer will choose integrated supply, he says. If we become complacent and become an order taker, were in danger.

Some manufacturers fear industry consolidation will dilute the ranks of safety specialists, further diminishing the importance of safety in the customers eyes.

Small niche companies being purchased by the big companies lose touch with the real purpose of PPE, says Richard Tinker of Paulson Manufacturing Corp. in Temecula, Calif.

Surfing for safety

More than two-thirds of distributors and 85 percent of manufacturers believe the Internet will have a major impact on their business in the next three years.

E-commerce is going to play a major role in the acquisition not only of safety products but products in general, says MSAs MacKenzie. By virtue of e-commerce, someone who is not a competitor to you today could be a competitor tomorrow, with a very low barrier of entry into that market.

The Internet has the potential to drastically change buying habits. Distributors and manufacturers are experimenting with how to best utilize this relatively new form of technology.

While studies show that business will greatly increase on Web sites, its still a young technology and people are addressing their strategies, says Crannell.

Some people believe e-commerce will fundamentally change the relationship between buyers, distributors and manufacturers. End-users will visit Web sites of manufacturers for technical information and product information and place orders through their local distributor.

Others fear the Internet will offer a conduit for end-users to order direct from manufacturers, further eroding distributor sales.

Neff of Uvex Safety disagrees that the Internet will someday spell doom for distributors. He says progressive distributors are linking their Web sites to manufacturers.

The distributors Web site will be the site for interactive commerce. Let the manufacturers site be the site for technical information, he says.

The best advice for safety specialists pondering what to do about e-commerce may be to learn how to use the technology to add value. A popular use of the Internet today is to post technical data, answer questions concerning safety issues and provide links to other sources of safety information, such as OSHA.gov and Safetycentral.org, the official site of SEDA and the International Safety Equipment Association (ISEA).

Were trying to learn more about what our customers really want to see on the Internet, says Stamn. Its not as easy as translating your catalog onto the Internet. Whether youre transitioning existing business from one channel to another or using it to get new business, you need a strategy.

How quickly and to what extent electronic commerce begins to affect distributor sales either positively or negatively is anyones guess.

Like integrated supply, alliances and other trends currently impacting safety specialists, e-commerce is a trend not likely to go away. Savvy safety distributors must discover how to use it to further demonstrate their value. If not, theyll continue to experience market-share erosion.

Safety distributors have to deliver on what theyve always been saying, and that is, we are professionals in safety, says Nichter. If not, then the value theyre bringing in the marketplace is relegated to nothing but products.

This article originally appeared in the July/August '99 issue of Progressive Distributor. Copyright 1999.

back to top back to Distribution Management archives

|