Building a winning strategy when consolidation looms

This article is adapted from Winning Strategies for a Consolidating Wholesale Distribution Industry, recently published by the Distribution Research and Education Foundation (DREF) of the National Association of Wholesaler-Distributors (NAW).

by Adam J. Fein

Many industrial distributors feel anxious about the strategic and competitive challenges posed by industry consolidation. At the same time, e-commerce is threatening the core value of distribution while simultaneously creating a new rationale for consolidation. Many large consolidated distributors provide e-fulfillment and logistics services for e-commerce companies.

In industrial distribution, international distributors are moving into the U.S. with aggressive acquisition programs. Many European consolidators already have larger revenues and greater profits than the biggest U.S. distributors.

The triggers for consolidation are familiar. Customers seek to streamline their purchasing and work with fewer, larger, well-capitalized distributors. Manufacturers begin to consolidate and encourage their distributors to get bigger. The cost and complexity of technology encourages a generation of entrepreneurs to all seek an exit strategy at the same time. The financial community adds fuel to the fire by investing in roll-ups and aggressive acquirers.

Distributors must have a strategic plan for their business that recognizes the reality of consolidation. Independent distributors face three basic strategic options: get big, get focused or get out. All other strategies are ultimately variations on these three options.

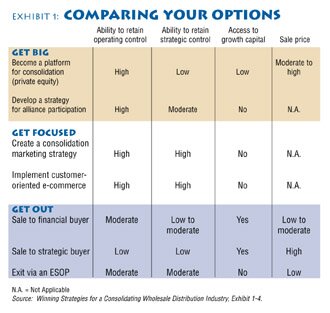

Exhibit 1 presents our integrative framework that highlights the tradeoffs among "get big, get focused or get out" options. We use the following criteria to compare alternatives:

Ability to retain operating control of the company. Does the strategy give you the authority and power to make decisions about day-to-day management and personnel issues?

Ability to retain strategic control of the company. Does the strategy give you the authority and power to make decisions about long-term company strategy and major investments?

Access to growth capital. Does the strategy provide you with the financial capital to undertake the strategy?

Sale price of the business (if relevant). What is the relative valuation that you can expect for your company?

Get big

One option is to become the consolidator. Distributors that pursue this option are likely to either establish a roll-up with similar companies or be a platform company in a private equity buildup.

Unfortunately, many distribution consolidators have been unable to integrate and operate their acquisitions. The fatal flaw of most consolidators is the inability to combine the benefits of a large, well capitalized, professionally managed corporation with the service and mindset of a wholesale distribution entrepreneur.

Few consolidators have figured out how to maintain this balance.

Today, the stock prices of public distributors severely underperform market averages as money flows out of so-called "old economy" companies into technology investments. As a result, public distributors can no longer use their stock to purchase private companies. The drop in stock prices has eliminated the arbitrage opportunities between the valuations of public and private companies, making the financial market returns harder to achieve.

Given the risks and costs of becoming a consolidator, many distributors have opted to appear bigger by participating in an alliance. Our survey of over 200 distributors revealed the three most important reasons for joining an alliance were better pricing from suppliers, the ability to remain independent, and competition from larger competitors.

Alliances and consolidators exist on a spectrum of alternatives for an independent distributor. For example, consolidations and alliances both provide broad geographic reach and create opportunities for volume purchasing from suppliers.

However, alliances have their own set of risks and rewards. The multitude of stakeholders - distributors, suppliers, and the alliance itself - create the possibility that effective strategic planning processes can be hijacked by organizational politics. A rapidly changing environment limits the ability of a loose affiliation to adapt. Alliances that provide little more than volume buying rebate checks will be under increasing pressure from consolidators.

Distributors should recognize they will need to make concessions to participate in an alliance group. In practice, these issues often boil down to balancing conformity with alliance strategies versus the ability to operate your business independently. We rate alliances as "moderate" on ability to retain strategic control in Exhibit 1.

One manifestation of this conflict can be seen in the preferred-supplier relationships developed by alliances. Under these agreements, a distributor member of an alliance is expected to provide additional support to the brands of partner-suppliers. A distributor may be asked to refrain from carrying brands from competing manufacturers in a specific product category. In exchange for this commitment, the supplier offers better pricing or extra marketing support, or agrees to limit its network of distributors.

The preferred suppliers may conflict with the existing selective distribution relationships of an individual wholesaler-distributor. This forces a choice between conformity and differentiation. Some distributors are reluctant to switch their customers to the alliance's brands.

Get focused

Well-run independent distributors continue to thrive, even in consolidating industries, due to their great skill in maintaining high levels of customer service and generating customer loyalty. Consolidators, in the quest for scale through standardization, inevitably end up under-serving certain customers. Smaller, more nimble distributors can exploit these market opportunities with a focused strategy aimed at groups of customers with unique but under-served needs.

Focus can take a number of forms. Increasingly, customers push for expanded services, including design-build support, integrated supply, integrated computer systems, joint marketing, and on-site deliveries. Services created in response to the needs of one group of customers can be expanded to a much wider group that never thought to ask for such help and that a national consolidator would not think to offer.

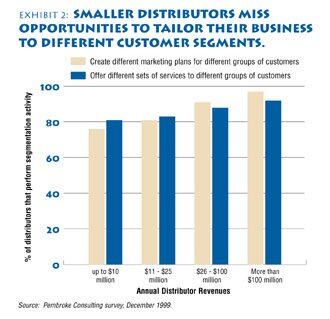

In a consolidating industry, it is critical for smaller distributors to take a segmented marketing approach. Smaller distributors

have fewer resources available to invest in marketing andbusiness development. Therefore, they need to segment their customers in order to make good decisions about which customers to pursue and which ones to leave alone.

Unfortunately, few smaller distributors take advantage of differences in needs across customer segments by developing tailored marketing plans (see Exhibit 2). In our survey data, nearly all wholesaler-distributors with revenues greater than $100 million create different marketing plans for different customer segments, whereas only three-quarters of those with revenues under $10 million tailor their marketing plans.

Of course, a focus strategy is unsustainable if customer needs flow toward a consolidator's business model. What if customers prefer to purchase online from a large catalog house because intelligent Web agents constantly deliver real-time, customized product information right to their desktops? Local service and personal visits may not be enough to overcome changing customer preferences.

Industrial distributors that focus on servicing a disappearing customer base will rapidly disappear themselves. The ongoing consolidation of MRO purchasing through national account programs can also defeat a niche strategy if smaller distributors cannot meet the emerging needs of larger customers.

To compete with a consolidator using e-commerce, an independent distributor should build and maintain customer loyalty - "stickiness" - through superior services. This requires a two-step analysis process. One, you must understand your customer's wants and needs. Two, you should design the appropriate technology-based services to service these needs.

In our new NAW book, my co-authors and I profile Kelly Supply, a general-line MRO distributor with two Web sites. Kelly's main site serves established, registered customers and incorporates individualized discounted pricing. Customers can order online, view sales history, track order status, check inventory levels at various locations and reorder standard product bundles.

The second site targets new customers through a new

subsidiary, Integrated Supply Co., and takes credit card orders only. Furthermore, the site is not limited to products that Kelly has in stock. Instead, the company has partnered with a number of its suppliers to offer direct shipping to customers at discount prices. This increases the range of products the site sells and improves its competitive price position.

To help get its customers online, Kelly also created an Internet Service Provider for its branch locations and surrounding areas. To date, 9,000 customers use this service to connect to the Internet. Kelly offers a credit of up to 2 percent of purchases toward the cost of signing up for this service.

Get out

The courage to face the future honestly often leads owners to look for a profitable exit strategy. The accelerating pace of consolidation, along with money flowing behind the consolidation concept, offers an opportunity to smart sellers who understand their options.

The best time to sell a company is when you do not need to sell: There is no financial pressure to repay creditors or create an instant retirement nest egg. Instead, plan a company transition as much as three to five years before you would actually sell the business. This will give you more negotiating leverage with a potential buyer. You may also gain flexibility to sell your company when the deal-making marketplace favors sellers.

Industries do not consolidate forever. So when is the market ripe for selling? The best time to get a premium valuation is when there are multiple buyers vying for the same targets.

There are also predictable patterns during a consolidation cycle. Prices are generally lower early in the consolidation timeline. At this point, the precise benefits of amalgamation are not clear, even to a consolidator. Doubters proclaim "our industry is different," generating increased uncertainty about the value of a consolidation strategy.

However, selling early gives you more strategic flexibility. You have more control over the sale process and can avoid a distress sale. Even if prices are lower, there are more buyers. The best companies have the opportunity to create an auction among potential consolidators. In our new book, we provide a case study of a construction equipment dealer that used a competitive acquisition market to negotiate very favorable terms with a buyer.

On the other hand, a chain-reaction of deals drives prices up, making it more profitable to sell later. Unfortunately, previous transactions take out many buyers, so you have less control over events as the consolidation end-game plays out. Delaying too long can dilute the value of your company if customers shift to the consolidator's business model.

Employee Stock Ownership Plans are another alternative for transfering ownership from the individual(s) who owns the company. When done effectively and carefully, an ESOP can be the foundation for building a strong company that grows and remains independent during an industry consolidation.

Building your strategy

Strategy making is harder today than ever. It is unlikely that any of us can make the single correct forecast when facing an indeterminate future and a rapidly evolving wholesale distribution industry.

Many distributors believed their customers were loyal because of a personal relationship, only to discover in a time of upheaval that their customers really cared mostly about price and availability. Conversely, other distributors worked themselves to the bone trying to match the new cut-rate price of the Big Box retailer across town, only to discover later that customers valued the advice and expertise of their sales force more than a fractional price difference.

Forward-looking executives recognize that consolidation requires a strategic view of how their own industries are evolving. Naturally, strategies and tactics vary from company to company and industry to industry. But if you fail to plan, you can surely plan to fail.

Winning Strategies for a Consolidating Wholesale Distribution Industry is available by calling NAW at or the NAW publications Web site, www.nawpubs.org.

Adam J. Fein is President of Pembroke Consulting Inc., a strategy consulting firm that specializes in wholesale distribution and business-to-business supply chains. He can be reached at or at www.PembrokeConsulting.com.

This article appeared in the September/October '00 issue of Progressive Distributor. Copyright 2000.

back to top back to Distribution Management archives

|