|

The emerging e-economy

MRO distributors charge into the 21st century with technology on the horizon.

by Richard Vurva and Frank Bernhard

An electronic economy is emerging among MRO distributors, according to an exclusive survey by Progressive Distributor and Omni Consulting Group LLP of Davis, Calif. The survey indicates that e-commerce will have a dramatic impact on distribution in the near future, and distributors are prepared to heavily invest in e-commerce capabilities.

But the results also show that distributors might want to proceed with caution in order to balance their e-commerce expectations against the hype surrounding the Internet. They also need to become more knowledgeable about available technologies, like bar coding and radio frequency technology, that can help them cut costs out of the supply chain.

Electronic commerce was one of four topics covered in the survey of distribution executives conducted during the summer. Other topics include information technology, distribution trends and knowledge management.

Here are highlights of our findings.

E-commerce

As reported in our September/ October issue, our survey indicates that one-third of distributors sell products via the Internet today and an additional 28 percent plan to invest in e-commerce technologies during fiscal year 2000.

More than 47 percent will spend $50,000 or more to deploy e-commerce technologies throughout their operation. Distributors with existing e-commerce systems in place plan to expand budget allocations toward greater Internet presence.

More than 35 percent of distributors with an Internet presence say that greater than half of their inventory is available for electronic order entry.

While a majority of distributors indicate that less than 3 percent of their total revenues are derived from Internet sales, nearly 72 percent believe future Internet sales will translate into double-digit growth in the next few years.

The fact that distributors report low Internet sales volume today, despite having a relatively high percentage of products available for sale over the Internet, points out the need for distributors to carefully weigh how they intend to utilize this new technology.

Its easy to get caught up in the excitement surrounding the Internet. While findings from our study suggest distributors anticipate growth in Internet sales, those companies entrenched in the e-commerce arena have not yet seen the explosive growth that the hype of technology suitors purport to be true. Distributors must be careful to make sure that their payback in terms of Internet sales is commensurate with their technology investment.

Knowledge management

Information systems are surfacing as the lead management tool of the decade. Yet, distributors may not be taking advantage of the tools technology provides to help them gather, store and disseminate information.

More than 31 percent of distributors use enterprise database systems to organize and store business-critical data, such as information about sales volume and marketing goals of customers, suppliers and competitors. An additional 47 percent express plans to introduce such systems in the future to capture and share knowledge throughout their organizations.

When asked how often employees input data to knowledge management systems, 28 percent say they do so daily. More than 58 percent say they update information on a weekly basis.

Analysis of the survey findings suggests respondents are more interested in learning about their competitors than about customers or suppliers.

Its also clear from the study that the primary source of information about customers, suppliers and competitors is the distributor sales force. More than 40 percent of the respondents indicated, however, that individual employees keep their own information, rather than utilize a centralized company-wide electronic database.

When asked how information travels from lower-level employees to upper-level management, 71 percent say its by word of mouth; 22 percent utilize database management systems.

Our conclusion: In the emerging e-economy, knowledge will become the most valuable commodity distributors possess. In order to effectively compete, distributors must act now to evaluate if theyre taking advantage of knowledge management tools that exist today.

Information technology

Sales automation and marketing management continue to be top priorities for most distributors. More than 35 percent of MRO distributors equip field salespeople with laptop computers and mobile sales solutions.

In addition to migrating toward the Internet to increase sales and lower costs, distributors also plan to utilize electronic data interchange (EDI) to help cut costs. Forty-eight percent of respondents say they conduct EDI with suppliers; an additional 37 percent plan to adopt EDI systems over the next 18 months.

The survey indicates that one of the primary reasons distributors utilize technology is to help them cut costs. Sixty-three percent respond favorably to the notion that technology aids in cost reduction.

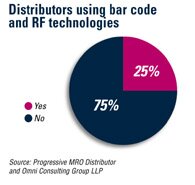

Its disturbing to note, however, that only about 25 percent of the respondents indicate they use bar code or radio frequency technology to control storage and retrieval in their warehouses. While more than 30 percent plan to implement bar coding within the next 18 months, only 8 percent plan to implement radio frequency technology. These are two additional examples of technologies that distributors might want to consider adopting if they are serious about utilizing technology to make their operations more efficient.

Distribution trends

The top three concerns of MRO distributors this year are: 1) Customer single-source relationships, 2) finding qualified personnel, and 3) economic conditions for 1999 and beyond.

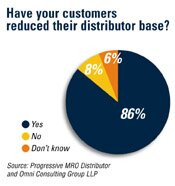

The vast majority of distributors (86 percent) say their customers have reduced the number of distributors they do business with. Not surprisingly, since customers are using fewer distributors to supply their MRO needs, nearly half of all survey respondents say their companies are carrying more brands per product line than in the past, and about one-third plan to increase their brands carried in the next two years.

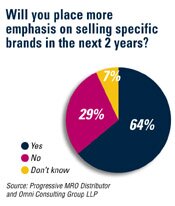

Despite carrying more brands, the data suggest that distributors are convinced of the value of product standardization. More than 43 percent of distributors say their sales volume is more concentrated among fewer brands today than two years ago. Nearly 64 percent expect to place more emphasis on selling specific brands within the next years.

In our opinion, the move toward product standardization is good news. It indicates that distributors recognize the benefits standardization offers customers, suppliers and distributors. It benefits customers because it provides them with economies of scale when they buy in larger volume and also reduces their transaction costs. It benefits distributors because it enables them to focus more of their resources on fewer, ostensibly more profitable, product lines. It benefits suppliers because it helps them build their brand and move greater numbers of products.

Changing times

Technology, the Internet and e-commerce clearly have the potential to dramatically change the business models of MRO distributors. In an industry rich with tradition, distributors are reticent to change. Yet, changes in technology are coming at a breakneck pace.

Not surprisingly, our survey indicates that many distributors lack knowledge to make key decisions about where to make investments in technology.

Part of the blame for this knowledge gap should be placed on the shoulders of technology vendors. Software providers and other technology vendors could spend more effort educating distributors about how to utilize technologies that can make their companies more efficient. Ultimately, however, its up to distributors to educate themselves about the emerging e-economy.

This article originally appeared in the November/December 1999 issue of Progressive Distributor. Copyright 1999.

back to top back to e-business archives

|